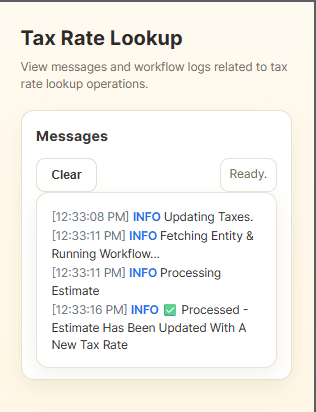

TaxJar Rate Lookup For Zoho Books

Automatically calculate and apply the correct sales tax in Zoho Books using real-time data from TaxJar — with optional Google Address Validation for pinpoint accuracy.

This integration retrieves the latest state, county, city, and district tax rates based on each customer’s verified shipping address, ensuring every transaction is compliant and precise. Whether you sell in one state or nationwide, it handles destination- and origin-based rules, freight taxability, and local jurisdiction nuances automatically.

Stay compliant, reduce manual work, and ensure your sales tax is always right — powered by TaxJar and Google Maps.